By: Abigail Hunter, Executive Director of the Center for Critical Minerals Strategy, SAFE, and Zubeyde Oysul, Senior Policy Analyst for the Center for Critical Minerals Strategy, SAFE

Unlike aluminum and steel where trade actions were designed primarily to bolster domestic production in the upstream, the Trump administration is taking a different tack with critical minerals. President Trump is signaling greater concern for preserving access to processed minerals and their derivatives at a moment when U.S. demand is surging, much of the country’s legacy processing capacity has been hollowed out, and new projects will not come online fast enough to significantly reduce import reliance.

That reflects a hard reality: there are real tradeoffs between competing policy priorities of supply chain security, manufacturing competitiveness, technological leadership, and affordable energy (these tensions are discussed with greater detail in SAFE’s report Trading Tensions: Navigating Policy Tools for a Diverse Critical Minerals Supply Chain). Tariffs on processed critical minerals and their derivative products would raise the cost of essential inputs for the economy. Those added costs become even more consequential when trade action is taken unilaterally.

Acting alone risks putting the United States at a disadvantage relative to foreign competitors that continue to source at lower prices—undermining the very leadership the United States is trying to build and maintain in advanced manufacturing and next-generation technologies.

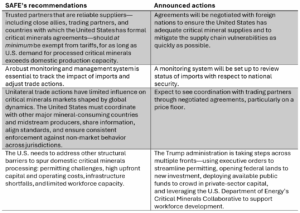

These considerations reflect issues SAFE raised in its public comments to the Bureau of Industry and Security. The administration’s effort to balance competing policy priorities aligns with SAFE’s recommendation to take country- and commodity-specific approach to avoid constrained supply or increased cost for downstream Industries:

The Trump administration is also taking a similarly nuanced approach in other sectors. For copper, the administration stopped short of imposing immediate Section 232 tariffs on refined imports, instead signaling the possibility of phased duties in the future. New import-adjustment offsets were introduced in October 2025 to reduce the impact of the 25 percent Section 232 tariffs on auto parts for manufacturers importing components for final assembly in the United States. The semiconductor actions announced the same day as the critical minerals decision exempted advanced chips used in data centers, R&D, and industrial applications from the new 25 percent Section 232 tariff.

Where trade negotiations can go

The announcement offers few details about what the trade negotiations will actually cover, beyond signaling that price floors are on the table. But these talks will not start from scratch. A series of framework agreements and memoranda of understanding announced in late 2025 serve as starting points for future negotiations.

The 2025 deals included commitments to work together on a wide range of issues: boosting investment, leveraging existing tools like industrial demand and strategic stockpiles to strengthen supply security, streamlining permitting, reviewing asset sales that could undermine national security, promoting critical minerals recycling, and expanding geologic mapping. They also took aim at non-market policies and unfair trade practices—calling for a standards-based system and exploring pricing mechanisms, including the use of price floors or similar tools. A more detailed assessment of these agreements can be found here.

The next round of negotiations will need to move beyond high-level intent toward clearer frameworks that are measurable and enforceable provisions. SAFE’s issue brief on critical minerals pricing mechanisms provides more information on the potential tools that can be used to uphold price floors. But negotiations to set up a fair, robust marketplace for critical minerals should tackle more than pricing and include the following:

- Tools to improve market transparency and give governments better visibility into beneficial ownership, pricing, production capacity, and trade flows so they can respond together to non-market behavior like overcapacity and opaque pricing.

- Transparency and traceability mechanisms to ensure materials meet agreed standards, including potential price floors, and to prevent third countries from using minor transformation or transshipments through trading partners with which the United States has negotiated agreements to circumvent tariffs or evade other protective measures.

- Clauses that promote export and import freedoms to safeguard U.S. national security interests from potential host country exports controls in the critical minerals sector.

- Provisions on information-sharing and enforcement actions to protect labor rights, including the opportunity for partner countries to reform their labor laws if they are non-existent or insufficient.

- Provisions on domestic measures to promote community engagement and reduction of environmental and societal impacts in mining and processing operations, including opportunities for partner countries to reform their environmental protection laws if they are non-existent or insufficient.

- Technical assistance and capacity building support to strengthen both the enforcement of existing regulations and the development of improved domestic legislation in the critical minerals sector.

- A dispute settlement provision for investors to challenge policies that violate agreed labor or environmental standards, or unfairly harm their investments.

- A dedicated Critical Minerals Committee, like the Timber Committee in the U.S.-Peru Trade Promotion Agreement, to monitor compliance with the trade agreement’s provisions. The Committee could recommend a range of actions, from issuing formal warnings to imposing trade sanctions or tariffs on critical mineral imports from the offending country until compliance is achieved if a country is found to be non-compliant with the agreed-upon standards. One possible enforcement mechanism can be modelled after the Rapid Response Mechanism under the United States-Mexico-Canada Agreement to allow the United States to impose tariffs on specific producers note abiding by the agreement’s terms.

A coordinated federal response

The U.S. Department of Commerce (DOC), Office of the U.S. Trade Representative (USTR), and the U.S. Department of Homeland Security (DHS) are directly implicated in the announcement. DOC will run a monitoring system and keep tabs on imports. USTR will lead negotiations with trading partners, and the Customs and Border Protection agency housed under DHS will be in charge of implementing future tariffs if trade negotiations fail. Just as important, DHS already plays a lead role in coordinating critical-infrastructure security across the federal government. Since critical minerals underpin all 16 infrastructure sectors, that creates a real opportunity to line up trade policy, industrial strategy, and national security planning.

Beyond the three agencies directly implicated, managing the national security risks tied to U.S. import dependence on processed critical minerals and their derivative products will require a whole-of-government approach. The U.S. Department of Treasury will continue to remain central to any serious discussion regarding price tools. The U.S. Department of State will be critical with its diplomacy efforts to support investments, policy coordination, and regulatory harmonization across allies.

The U.S. Department of Energy and Pentagon will continue to help define strategic needs for the energy and defense sectors, identify vulnerabilities in midstream processing, and inform policy priorities alongside DOC. Their investments will be necessary alongside the Export-Import Bank of the United States’ (EXIM) Make More in America program (MMIA) to help crowd in private sector capital to domestic critical mineral projects.

The U.S. Department of Interior will play a key role in geologic mapping and, along with the U.S. Forest Service, permitting mine projects on federal lands to produce feedstock for processing and manufacturing activities. The U.S. Geological Survey will also be critical, both in strengthening the nation’s understanding of domestic resource potential and in informing partnerships with countries that can help fill supply gaps where U.S. geology or production capacity falls short.

EXIM and the U.S. Development Finance Corporation will support international critical minerals investments in cases where projects cannot be advanced domestically due to geological constraints or other structural limitations.

Finally, the White House, working through the National Security Council and the National Energy Dominance Council, will play a central role in coordinating efforts across the federal government.

Policy uncertainty or strategic ambiguity?

Several factors help explain why the Trump administration’s announcement this week lacks specificity beyond these high-level actions. The timeline for the investigation was unusually tight, especially given its broad scope. The Department of Commerce had 180 days to conduct investigations on 60 critical mineral supply chains, while simultaneously running 11 other Section 232 investigations into copper, semiconductors, timber, pharmaceuticals, medium- and heavy-duty trucks, polysilicon, commercial aircraft and jet engines, unmanned aircraft systems, wind turbines, essential healthcare supplies like personal protective equipment, and industrial machinery and robotics. With a finalized investigation, the administration is better positioned to develop and advance tailored actions that better reflect the distinct risks, market dynamics, and strategic priorities of individual critical mineral supply chains.

Geopolitical concerns also likely came into play. Ongoing tensions with China and the one-year truce reached following the October 2025 export controls raised the stakes of policy action. Sensitivities to these dynamics are clear in the proclamation. U.S. import reliance on foreign adversaries is not mentioned. Unsustainable price volatility is flagged as a problem that needs to be addressed, but price manipulation concerns are not mentioned. This is where the strategic ambiguity comes in. On the one hand, it helps avoid upsetting a delicate diplomatic balance. On the other, it prevents China from getting early signals it could use to blunt or counter future U.S. actions. Industry, however, still needs clear policy direction.

The lack of detail now will not limit what comes next. A Section 232 investigation gives the President broad authorities and, with a monitoring system in place, the President is no longer bound by a narrow decision window to take action. We saw this playbook in action before: the Section 232 tariffs on autos and auto parts announced in 2025 were built on an investigation and monitoring system established under the first Trump administration.

The task for the administration now is to strike the right balance—maintaining enough flexibility in public posture to protect U.S. leverage and interests, while signaling policy intent clearly enough to guide investment and long-term planning in critical minerals supply chains.

Next steps to watch out for

The first update to the President on the status of negotiations is due in 180 days—July 13, 2026. Between now and then, there will be multiple opportunities to shape the path forward, both bilaterally and through multilateral forums. One of the earliest engagements is the February 4 foreign ministers’ meeting that will be hosted by Secretary Rubio to discuss next steps to fortify critical mineral supply chains with allies.