Featured Story

What Welcoming Chinese Automakers Means for National Security

Same as it ever was? Not this time. Foreign investment from a direct adversary won't end well.

READ MORESame as it ever was? Not this time. Foreign investment from a direct adversary won't end well.

READ MORE

LNG prices in northeast Asia are up more than 80 percent in just two weeks, capping off a wild bust-to-boom swing in a little over six months.

As continued OPEC curbs alongside a further hefty Saudi cut nudge WTI back above $50 per barrel, U.S. shale drillers have pulled back from the abyss.

Despite the latest sanctions on Nord Stream 2, Russia has vowed to complete the project.

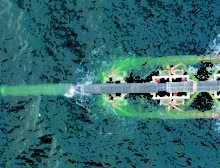

Some of the networks under U.S. sanctions have developed intricate tactics to keep oil flowing to Syria.

The end-of-year omnibus bill contains the first major energy legislation in more than a decade.

The EU's latest climate goals will have a profound effect on energy markets.

As Iran anticipates a lifting of sanctions, it will return to a very different oil market where Iraq has filled the vacuum.

Despite cuts to drilling and spending, the U.S. natural gas slump continues—particularly in Appalachia.

Amid internal discord and budget pressures, OPEC+ has reportedly agreed to incremental production increases and monthly monitoring.

Underinvestment, fiscal stimulus and a weaker dollar could form the foundation for a commodity super-cycle.

Subscribe